Central Bank of India CSP

In order to leverage banking infrastructure in unbanked areas of India, under the Financial Inclusion Plan, the government of India has implemented the idea of Central Bank Of India Kiosk Banking through their business correspondents.

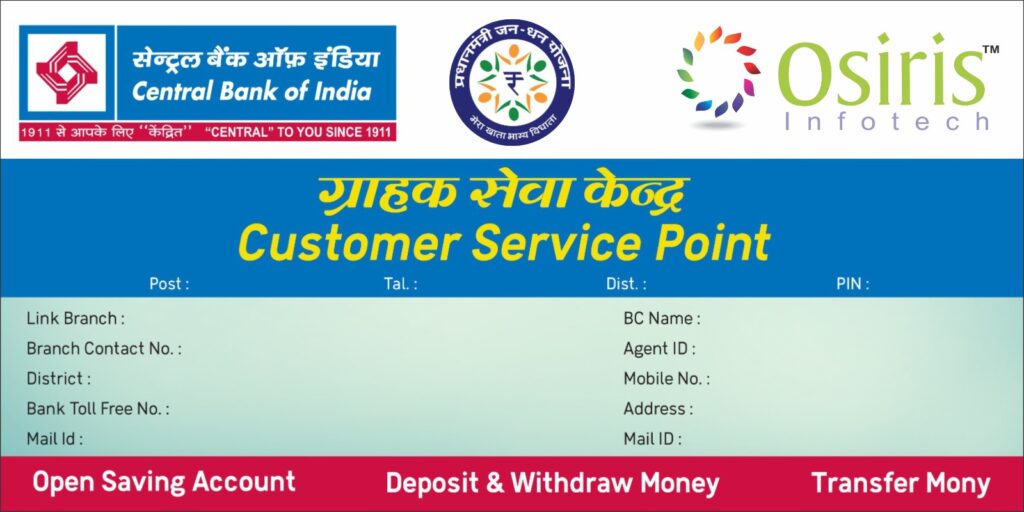

Central Bank Of India CSP or Central Bank Of India Kiosk banking is a concept that has been designed under Public Private Partnership. Here the CBI Kiosk is a private entity that represents Central Bank Of India in a local area where banks are not present in brick and mortar due to scarcity of resources. Such CBI Kiosks offers banking facilities like Cash withdrawal, cash deposit, account opening, money transfer etc. Apart from basic banking facilities, CBI CSP offers financial plans like Pradhan Mantri Jan Dhan Yojna to implement the government schemes.

Here is how you can become a Bank of Baroda CSP

To become a Central Bank Of India CSP, you need to apply Here

Before making a Central Bank Of India CSP online application, you should meet following criterion.

- Should be more than 18 years of age

- Must have completed education of 10 + 2

- Should possess computer and have knowledge for same.

- Minimum office space to function

- Minimum investment as guided by Central Bank Of India BC